Your Gift Makes a Difference

Philanthropic gifts play a crucial role in the progress and continuing success of the College of Education. Accomplishing our vision to become the preeminent education program in the country depends on the continued and generous support of our alumni, friends and corporate stakeholders. Giving to the college, at any level, is a wonderful way to say thank you for outstanding education, transformative experiences and a great network of friends.

Why Give to the College of Education?

The College of Education is one of the top programs in the nation. Private support is increasingly important as other sources of funding continue to decrease. Your gifts ensure sustained excellence.

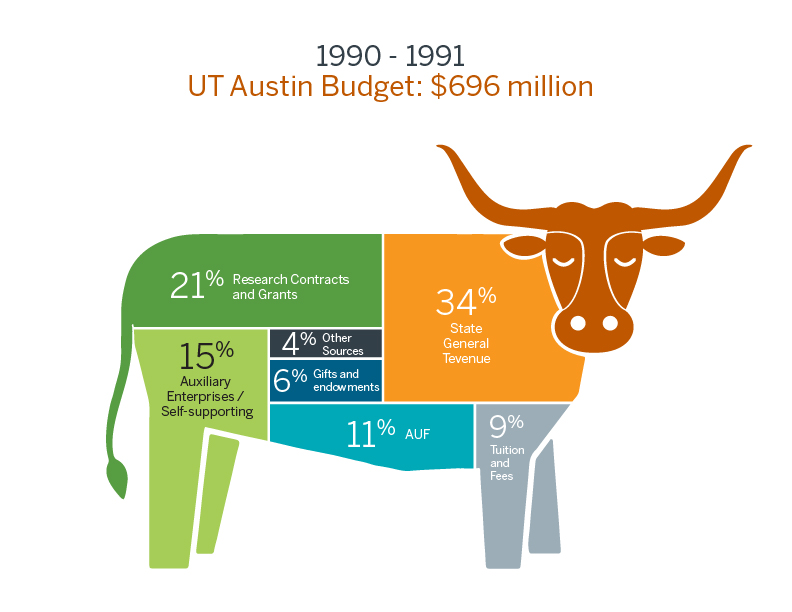

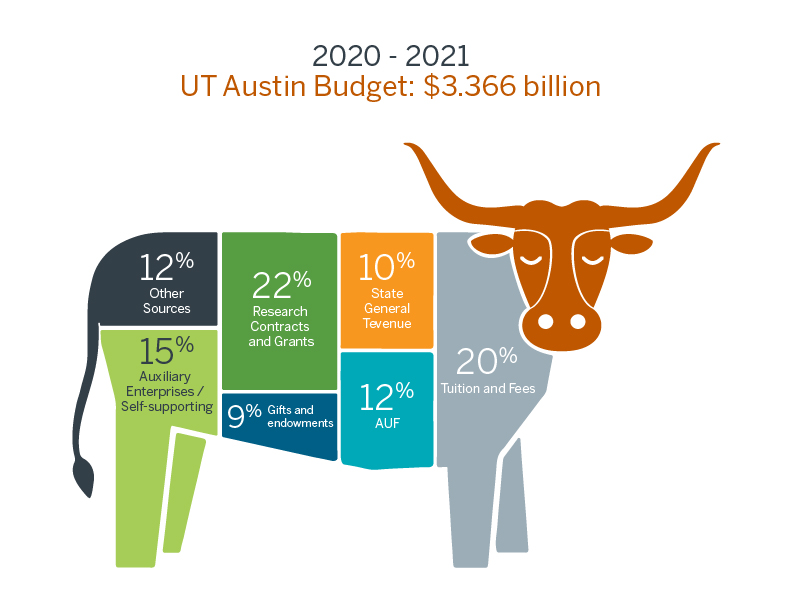

State funding previously provided 47% of the university’s budget. Today that number is only 12%. Many people think that UT is rich because we receive revenue from the Available University Fund (AUF). The College of Education needs your support to compete for the world’s best talent. Giving to the college shows your dedication to higher education and to our mission to educate leaders that create value for society.

Ways to Give

Your gift helps us change the world. Any type of giving is a wonderful way to say thank you for an outstanding education, to show support for the college and to give back so that others can enjoy the transformative UT experience.

Annual Fund

The College of Education will not thrive on the gift of one, but the support of many. By supporting the College of Education Annual Fund, donors impact the future of the school and become active participants in its evolution and advancement. Annual Fund donors can take pride in each accomplishment of the school, each award, each discovery, each step on the way to preeminence. When you make a gift to the Annual Fund, you join the larger College of Education team of supporters and can rightfully say, “We did that.”

Annual Fund gifts typically range from $50 to $5,000 and are used by the college to support several important areas. Your participation is as important as the amount you give. Alumni giving is one factor used in many national and international rankings and is an indication of alumni confidence in the direction of the institution. Annual Fund gifts are the cornerstone of academic philanthropy.

To learn how you can give to the CoE Annual Fund, contact Jillian Gillie, (512) 232-5012.

Outright Gifts

Outright gifts support immediate needs and have a powerful impact on the College of Education. Ranging from $5,000 to $25,000, outright gifts support a variety of initiatives and are an excellent way to support current needs.

To learn how you can make an outright gift, contact Wendy Elder, (512) 475-8133.

Endowments

Endowments at the College of Education are sound investments in a bright future. With an endowed gift, you can provide permanent support for the college. Your gift is invested — never spent — and each year a partial distribution of the earnings is made to the chosen program or area. Investment earnings not distributed help the endowment value grow over time, to keep pace with inflation and maintain the endowment’s spending power.

You may take up to five years to fund an endowment, and once it is officially established, you may continue to add to its principle at any time. With the opportunity to select the title of the endowment, you can forever link your name, or that of a family member, friend or organization, to scholarly excellence at the College of Education.

To learn how you can establish an endowment, contact Wendy Elder, (512) 475-8133.

Planned Gift

A planned gift can be extremely flexible, include many tax advantages and provide you with reliable lifetime income while ultimately directing valuable resources to the College of Education. You can choose to develop a philanthropic plan that will ensure a secure future for the College of Education and its students through a bequest or other planned giving vehicles. By including the college in your retirement and estate plans, you can diminish tax burdens while supporting students, faculty and other initiatives.

Charitable gift annuities, which provide immediately fixed payments for life with the remaining funds distributed to the College of Education, offer one option. Or you may find it more attractive to do a charitable remainder trust that converts significantly appreciated assets into cash payments while eliminating capital gains taxes. If created through a will, this is one of the best ways to roll over qualified retirement-plan assets to leave more for both heirs and charitable interests.

For more information about planned giving, please contact Catherine Fendrich-Turner, director of gift and estate planning, (512) 232-8054 (direct) or (800) 687-4602.

Basic Bequest Language

I hereby direct $___________ (or ____ percent of my residual estate) in cash, securities, or other property to the Board of Regents of The University of Texas System for the benefit of The University of Texas at Austin. This gift shall be for the further benefit of _____________[college, school, unit] and shall be used to __________[purpose].

For your information, our tax ID number is 74-6000203.

Make a Gift Online

Access the convenience of secure online giving through the university’s giving page. Be sure to choose “Education, College of” in the first drop down box to direct your gift to the college. Make your online gift today.

Send a Check via U.S. Mail

All checks in support of the College of Education should be made payable to The University of Texas at Austin. Please note in the memo line your gift’s designation within the college. Checks should be mailed to the address listed below.

College of Education

The University of Texas at Austin

1912 Speedway

Mail Stop D5000

Austin, TX 78712-0287

Telephone: (512) 471-8178

Fax: (512) 471-0846

Match Your Gift

You can maximize the impact of your giving to the College of Education through employer matching gift programs. Most matches are dollar-for-dollar (1:1), doubling the value of your gifts. Some companies match the gifts of retirees and spouses as well as those of active employees.

Make a Bequest or Planned Gift

Gift planning is one of the most powerful ways you can support the College of Education. Through a planned or deferred gift, donors can positively affect the future of the college and its students. Learn more about structuring a gift that will help you honor your values and meet your personal, financial and estate planning goals. For more information about planned giving, please contact Katy Fendrich-Turner, director of gift and estate planning, (512) 232-8054.

Transfer Stock

A gift of appreciated stock is an excellent way to support the college, simultaneously avoiding capital gains tax and taking a charitable deduction. To ensure proper processing, donors should alert a staff member in the College of Education at 512-232-5012 to request transfer instructions.

Make a Wire Transfer

Wire transfers are most commonly used with gifts made from outside the United States or for large gifts within the U.S. To ensure proper gift credit, donors should contact a staff member in the College of Education at (512) 232-5012 to request transfer instructions.

Faculty and Staff Payroll Deduction

Are you a UT employee? If so, you can support the college through payroll deduction. Set up your payroll deduction.